Picture this: an average Australian property investor.

Now, if your first thought was a greedy big fish with stockpiles of purchased addresses stashed away, selling them for ludicrous profits at the expense of a younger market, then you’re probably not alone on that one.

But, chances are, you’re also probably not a property investor yourself.

Many assumptions are made about property investment, and whether or not the decades-old strategy will still get you ahead in Sydney in 2021. After all, there has to be a reason behind the 20% of Australians who invest in property, right?

To answer that, let’s take a look at what the average Aussie property investor actually looks like. According to Corelogic (via propertyupdate.com.au), from the latest data available in 2017-2018):

- Around 71% of property investors hold one investment property

- Around 19% hold two

- Around 6% hold three – dropping to less than 1% holding six or more.

That is, 90% of property investors in Australia own only one or two investment properties. And of those:

- 59.5% are aged 50+

- 38.87% are aged 30-49

- 1.63% are younger than 30.

Taking the above into account, it may come as a surprise that not all investors are wealthy retirees with a hoard of investments – and that an unexpected number are middle-aged, working class and settling at one or two properties.

So then, is property investment really all the wealth and rewards it paints out to be?

The short answer is yes, when done right.

As with any other type of investment, investing in property isn’t straightforward.

It takes:

- Buying at the right stage of the property cycle (and therefore price);

- Choosing something that is ‘investment grade’; in a good location, and with solid potential to add value and increase in capital growth; and

- Understanding the value of exceptional property management to maximise your investment.

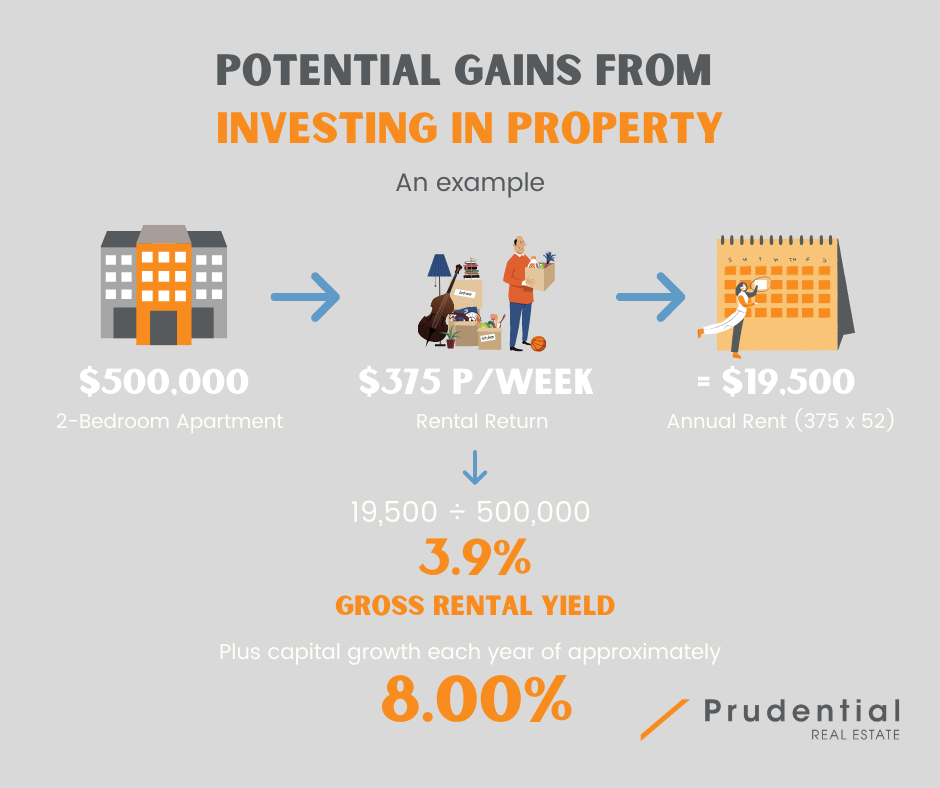

The below infographic gives an example of what you could gain from owning an investment property:

Notably, this example is based on maximising your returns, which is where top-tier property management service comes into the mix.

Take the current market, which has an average of 31.1 days vacant in Sydney (or days that a rental property is sitting empty and not yielding any rental income). Compare this with 11 days vacant that is the current average at Prudential Real Estate Campbelltown, and you could be hundreds (or more likely, thousands) ahead just by choosing the right property management service.

This is also the case for how long your investment property sits on the market, where Prudential’s average is just 9 days – that is 30 days less than the local Campbelltown average. This is equivalent to a whole month of rent (or $1500 total, based on the example of $375 per week) extra in your pocket, from opting for a top-tier agent.

Whilst seemingly trivial, it’s these figures that are key to gaining maximum financial benefit from your investment – the aim of the game after all.

Of course, having a high-quality tenant who pays their rent on time and looks after your property is equally important. At Prudential Real Estate we manage one of the single largest rental portfolios in Sydney, with 30+ years of experience behind our top-tier results. Our landlords not only enjoy the benefit of considerably low vacancy rates and having their property leased 30 days faster (on average) than the local market, but also some of the lowest rent arrears in Australia too (yes, in Australia).

We’ve mastered a unique 293-step property management system to protect our clients and their investment, which offers exceptional value for money along with our timely and renowned stress-free service.

Ultimately, property investors are as rich as the quality of their property strategy. Understanding the market and choosing the right property at the right time is key, as well as having a skilled partner in an experienced property manager – one that will save you time and money finding a great tenant, managing the condition of your property and protecting your investment.

Just do the math!

Prudential Real Estate Campbelltown | (02) 4628 0033 | campbelltown@prudential.com.au

Prudential Real Estate Liverpool | (02) 9822 5999 | liverpool@prudential.com.au

Prudential Real Estate Macquarie Fields | (02) 9605 5333 | macquariefields@prudential.com.au

Prudential Real Estate Narellan | (02) 4624 4400 | narellan@prudential.com.au